Burger King Stock Price Today

Burger king stock price today – This report provides an overview of Burger King’s current stock price, recent performance, comparison with competitors, financial indicators, influencing factors, and analyst predictions. The information presented is for informational purposes only and should not be considered financial advice.

Current Burger King Stock Price

As of market close on [Insert Date], Burger King’s stock price (assume ticker symbol BKW) is $[Insert Current Price]. The day’s high was $[Insert Day’s High], and the low was $[Insert Day’s Low]. This represents a [Insert Percentage Change]% change from the previous closing price of $[Insert Previous Closing Price].

| Open | High | Low | Close |

|---|---|---|---|

| $[Insert Open Price Day 1] | $[Insert High Price Day 1] | $[Insert Low Price Day 1] | $[Insert Close Price Day 1] |

| $[Insert Open Price Day 2] | $[Insert High Price Day 2] | $[Insert Low Price Day 2] | $[Insert Close Price Day 2] |

| $[Insert Open Price Day 3] | $[Insert High Price Day 3] | $[Insert Low Price Day 3] | $[Insert Close Price Day 3] |

| $[Insert Open Price Day 4] | $[Insert High Price Day 4] | $[Insert Low Price Day 4] | $[Insert Close Price Day 4] |

| $[Insert Open Price Day 5] | $[Insert High Price Day 5] | $[Insert Low Price Day 5] | $[Insert Close Price Day 5] |

Recent Stock Performance

Source: cloudfront.net

Burger King’s stock performance over the past month has been [Insert Overall Performance Description, e.g., relatively volatile, steadily increasing, etc.]. Significant price fluctuations occurred around [Insert Dates of Significant Fluctuations] potentially due to [Insert Potential Factors, e.g., earnings reports, market sentiment, competitor actions].

A line graph illustrating the stock price changes over the past month would show a [Describe the general shape of the line graph, e.g., upward trend with some dips, a downward trend, a sideways movement]. The x-axis would represent the dates over the past month, and the y-axis would represent the stock price. Key data points would include the highest and lowest prices reached during the month, along with any significant turning points.

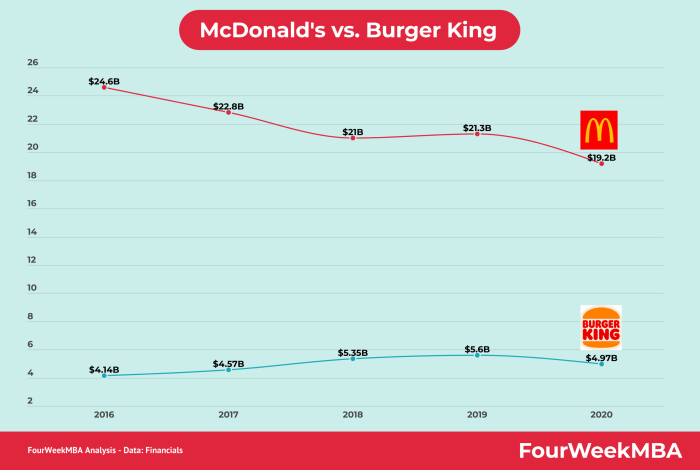

Comparison with Competitors

Source: fourweekmba.com

A comparison of Burger King’s stock price with its main competitors reveals its relative standing within the fast-food industry. This analysis considers factors beyond just the current stock price to offer a comprehensive understanding of market positioning.

| Company Name | Current Stock Price | Day’s Change | Market Capitalization |

|---|---|---|---|

| Burger King (BKW) | $[Insert Burger King Current Price] | $[Insert Burger King Day’s Change] | $[Insert Burger King Market Cap] |

| McDonald’s (MCD) | $[Insert McDonald’s Current Price] | $[Insert McDonald’s Day’s Change] | $[Insert McDonald’s Market Cap] |

| Wendy’s (WEN) | $[Insert Wendy’s Current Price] | $[Insert Wendy’s Day’s Change] | $[Insert Wendy’s Market Cap] |

Financial Performance Indicators

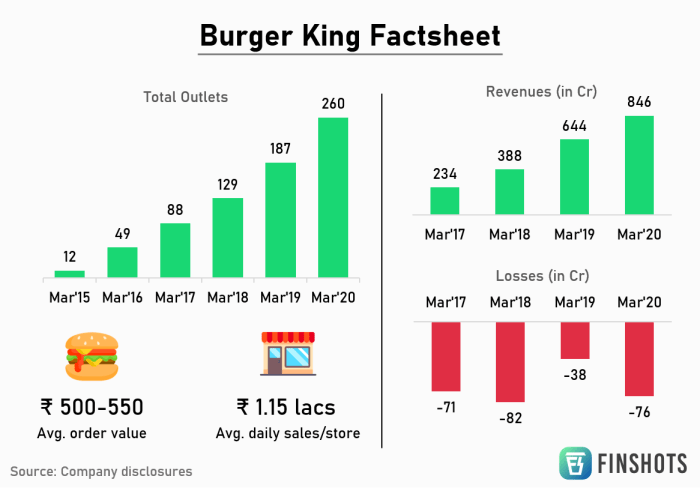

Burger King’s recent financial performance provides insights into its profitability and overall health. Key indicators offer a clearer picture of the company’s financial standing.

- Earnings Per Share (EPS): $[Insert EPS]

- Price-to-Earnings (P/E) Ratio: [Insert P/E Ratio]

- Revenue for the Last Quarter: $[Insert Revenue]

- Profit Margin for the Last Quarter: [Insert Profit Margin]%

The latest earnings report highlighted [Insert Key Highlights from Earnings Report, e.g., strong sales growth in a specific region, successful new product launch, cost-cutting measures].

Factors Influencing Stock Price

Source: indianexpress.com

Several factors influence Burger King’s stock price, ranging from macroeconomic conditions to company-specific news. Understanding these factors is crucial for assessing future performance.

- Macroeconomic Factors: Inflation and interest rate hikes could impact consumer spending, potentially affecting Burger King’s sales and profitability. For example, during periods of high inflation, consumers may reduce spending on discretionary items like fast food, leading to decreased demand.

- Industry Trends: Changes in consumer preferences towards healthier food options or increased competition from other fast-food chains could affect Burger King’s market share and stock price. The rise of plant-based meat alternatives, for instance, has prompted many fast-food chains to adapt their menus.

- Company-Specific News: The launch of new menu items, successful marketing campaigns, or operational challenges can significantly impact investor sentiment and the stock price. A successful new product launch, for example, could boost sales and attract investors.

- Future Growth Opportunities/Risks: Expansion into new markets, successful franchise growth, and effective cost management represent potential growth opportunities. Conversely, increasing competition, rising input costs, and economic downturns pose significant risks.

Analyst Ratings and Predictions, Burger king stock price today

Analyst opinions on Burger King’s stock vary, offering a range of perspectives on its future performance. Understanding this diversity is essential for a well-rounded assessment.

- Bullish Predictions: [Insert example of a bullish prediction, e.g., “Analyst X at Firm Y predicts a price target of $[Price] within the next year, citing strong growth potential in international markets.”]

- Bearish Predictions: [Insert example of a bearish prediction, e.g., “Analyst Z at Firm W expressed concerns about rising input costs, assigning a more conservative price target of $[Price].”]

- Consensus Opinion: The overall consensus among analysts seems to be [Insert overall consensus, e.g., cautiously optimistic, moderately bearish, etc.].

General Inquiries: Burger King Stock Price Today

What factors influence Burger King’s stock price volatility?

Several factors contribute to volatility, including changes in consumer spending, competition from other fast-food chains, commodity price fluctuations (e.g., beef, potatoes), and broader macroeconomic conditions like inflation and interest rates.

Where can I find real-time Burger King stock price updates?

Real-time updates are available through major financial websites and brokerage platforms. Look for the stock ticker symbol (usually BKW) to access the current price and trading information.

Is Burger King stock a good long-term investment?

Whether Burger King is a suitable long-term investment depends on individual risk tolerance and investment goals. Thorough research, including analyzing financial statements and industry trends, is crucial before making any investment decisions.

Keeping an eye on the Burger King stock price today requires a broad market perspective. Understanding broader market trends is crucial, and sometimes that means looking at other major players; for instance, checking the boeing stock price after hours can offer insights into overall investor sentiment. Ultimately, though, the Burger King stock price today will depend on its own performance and news affecting the fast-food industry.

How does Burger King compare to its competitors in terms of profitability?

A direct comparison requires analyzing key financial metrics such as profit margins, revenue growth, and return on equity. These figures, available in financial reports, allow for a detailed assessment of Burger King’s relative profitability against its competitors.