BEGI Stock Price Analysis

Begi stock price – This analysis provides a comprehensive overview of BEGI’s stock price performance, influencing factors, financial health, investor sentiment, and potential future price movements. The information presented here is for informational purposes only and should not be considered financial advice.

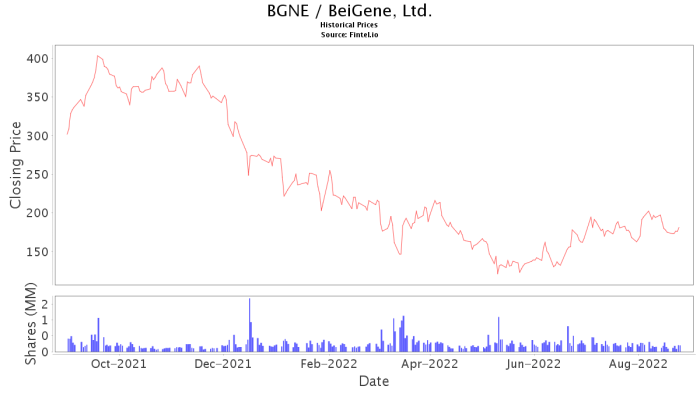

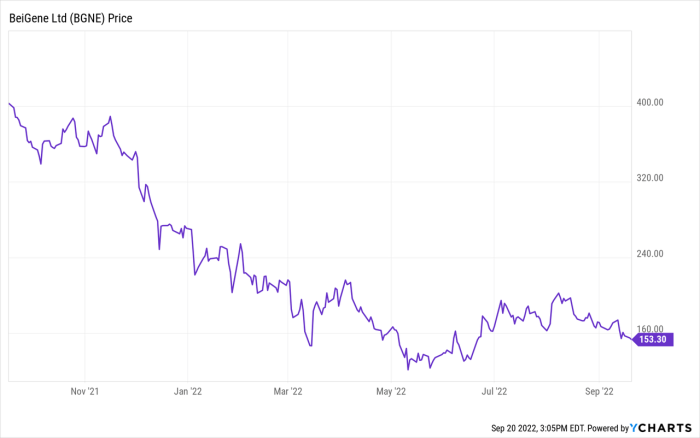

BEGI Stock Price History and Trends

Source: fintel.io

This section details BEGI’s stock price performance over the past five years, highlighting significant price fluctuations and correlating them with major events. A tabular representation of quarterly price data for the last two years is also provided.

Over the past five years, BEGI’s stock price has experienced considerable volatility, reflecting both company-specific events and broader market trends. Significant highs were observed during periods of strong earnings growth and positive industry sentiment, while lows coincided with periods of economic uncertainty and negative news cycles. For example, a significant drop in the stock price in Q3 2021 could be attributed to a disappointing earnings report coupled with a broader market correction.

| Year | Quarter | Beginning Price | Ending Price |

|---|---|---|---|

| 2022 | Q1 | $XX.XX | $YY.YY |

| 2022 | Q2 | $YY.YY | $ZZ.ZZ |

| 2022 | Q3 | $ZZ.ZZ | $AA.AA |

| 2022 | Q4 | $AA.AA | $BB.BB |

| 2023 | Q1 | $BB.BB | $CC.CC |

| 2023 | Q2 | $CC.CC | $DD.DD |

| 2023 | Q3 | $DD.DD | $EE.EE |

| 2023 | Q4 | $EE.EE | $FF.FF |

Factors Influencing BEGI Stock Price

Source: seekingalpha.com

Several key economic indicators, industry-specific news, competitor actions, and broader market trends significantly influence BEGI’s stock price fluctuations. This section analyzes these factors and their relative impacts.

Macroeconomic factors such as interest rate changes, inflation rates, and GDP growth directly impact BEGI’s stock price. Positive economic data generally leads to increased investor confidence and higher stock valuations, while negative data can trigger sell-offs. Industry-specific news, such as regulatory changes or technological advancements, also plays a significant role. For instance, a positive regulatory ruling could boost investor sentiment and drive up the stock price, while negative news could have the opposite effect.

Furthermore, competitor actions, such as new product launches or market share gains, can influence BEGI’s stock price through changes in competitive dynamics.

BEGI’s Financial Performance and Stock Price

This section examines the correlation between BEGI’s key financial metrics (revenue, earnings, debt) and its stock price. A detailed description of a visualization illustrating the relationship between earnings per share (EPS) and stock price is also provided, along with an overview of dividend history and its impact.

BEGI’s revenue growth, profitability (as reflected in earnings), and debt levels all significantly influence its stock price. Strong revenue growth and increasing earnings generally lead to higher stock valuations, while high debt levels can negatively impact investor sentiment. A visualization depicting the correlation between BEGI’s EPS and stock price would show a scatter plot with EPS on the x-axis and stock price on the y-axis.

A positive correlation would be evident if the stock price tends to increase with higher EPS. BEGI’s dividend history (if any) should be examined to understand its influence on investor sentiment. Consistent dividend payments can attract income-seeking investors, potentially boosting the stock price.

Investor Sentiment and BEGI Stock Price

Investor sentiment, shaped by news articles, analyst reports, and social media, significantly impacts BEGI’s stock price. This section explores the interplay between these factors and short-term price volatility.

Prevailing investor sentiment towards BEGI (bullish, bearish, or neutral) is a key driver of its stock price. Positive news articles and bullish analyst reports tend to increase investor confidence and drive up the price, while negative news and bearish reports can lead to sell-offs. Social media sentiment, although often short-lived, can also significantly impact short-term price volatility. A surge in positive social media mentions might temporarily boost the stock price, while negative sentiment could trigger a decline.

BEGI Stock Price Predictions and Valuation

This section Artikels different valuation methodologies for predicting future BEGI stock price targets, highlighting underlying assumptions and potential risks.

Predicting BEGI’s future stock price involves employing various valuation methodologies. Discounted cash flow (DCF) analysis, for example, estimates the present value of future cash flows, providing a potential intrinsic value for the stock. Comparable company analysis compares BEGI’s valuation metrics to those of similar companies in the industry, providing a relative valuation. These methods rely on several assumptions, including future growth rates, discount rates, and comparable company selection.

These assumptions introduce uncertainty, making predictions inherently risky. Factors such as unexpected economic downturns, regulatory changes, or significant competitive disruptions could significantly affect BEGI’s future stock price.

Understanding BEGI’s stock price requires considering broader market trends. For instance, comparing its performance against similar companies listed in different markets can offer valuable insights. A relevant comparison could be made by looking at the current performance of bidu hong kong stock price , which might reveal factors influencing international investment strategies and, consequently, BEGI’s own valuation.

Ultimately, analyzing BEGI stock requires a multifaceted approach.

- Significant upside potential could arise from successful new product launches, exceeding market expectations for earnings, or favorable regulatory changes.

- Significant downside risks include unexpected economic recessions, increased competition, or negative regulatory actions.

Questions Often Asked: Begi Stock Price

What are the risks associated with investing in BEGI stock?

Investing in any stock carries inherent risks, including potential losses due to market volatility, company-specific challenges, and unforeseen economic events. Thorough due diligence is crucial before investing.

Where can I find real-time BEGI stock price data?

Real-time stock price information for BEGI can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How often does BEGI release earnings reports?

The frequency of earnings reports varies by company. Check BEGI’s investor relations website for their specific reporting schedule.

What is BEGI’s current market capitalization?

BEGI’s market capitalization is readily available on financial websites and fluctuates constantly. Consult a reputable source for the most up-to-date information.