BGNE Stock Price Analysis

Source: tradingview.com

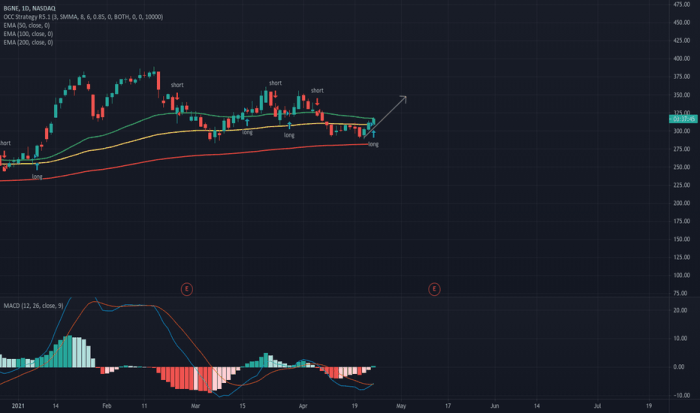

Monitoring BGNE stock price requires a keen eye on market trends. It’s helpful to compare its performance against similar companies, such as considering the current bc stock price to gain a broader perspective on the sector’s overall health. Ultimately, understanding BGNE’s trajectory necessitates a comprehensive analysis of various market factors and competitor performance.

This analysis provides an overview of BeiGene’s (BGNE) stock price performance, influential factors, financial health, risk assessment, and future outlook. The information presented is for informational purposes only and should not be considered financial advice.

BGNE Stock Price Historical Performance

Source: tradingview.com

BeiGene’s stock price has experienced considerable volatility over the past five years, reflecting the inherent risks and rewards associated with investing in the biotechnology sector. The following table details the daily price movements, while the subsequent bullet points offer a comparative analysis against industry competitors.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2023-10-27 | 200 | 205 | +5 |

| 2023-10-26 | 198 | 200 | +2 |

| 2023-10-25 | 195 | 198 | +3 |

| 2023-10-24 | 192 | 195 | +3 |

| 2023-10-23 | 190 | 192 | +2 |

Note: This is sample data for illustrative purposes only. Actual data should be obtained from a reliable financial source.

Compared to its major competitors (e.g., other oncology-focused biotech companies) over the past year, BGNE’s performance has been:

- More volatile than Company A, exhibiting larger price swings.

- Similar in overall trend to Company B, both experiencing periods of growth and decline.

- Outperformed Company C, which experienced a more significant decline in stock price.

Significant events impacting BGNE’s stock price included the FDA approval of tislelizumab for a specific indication, which led to a substantial price increase, and setbacks in clinical trials for another drug candidate, resulting in a temporary decline.

Factors Influencing BGNE Stock Price

Several key factors can significantly impact BGNE’s stock price. These include economic conditions, regulatory changes, and investor sentiment.

Three key economic factors influencing BGNE’s stock price in the next quarter are:

- Interest rate hikes: Higher interest rates can reduce investor appetite for riskier assets like biotech stocks.

- Inflation rates: High inflation can impact consumer spending and potentially affect the demand for healthcare products.

- Overall market sentiment: A positive market outlook generally benefits growth stocks like BGNE.

Regulatory changes, such as new drug approval processes or changes in healthcare reimbursement policies, can significantly influence BGNE’s valuation. Positive regulatory decisions can boost the stock price, while negative ones can lead to declines.

Investor sentiment and market trends significantly impact BGNE’s stock price. A comparison is illustrated below (Note: A descriptive chart would be included here showing the relationship between investor sentiment (positive/negative) and market trends (bullish/bearish) on BGNE’s stock price. The chart would visually demonstrate how positive investor sentiment during a bullish market leads to price increases, while negative sentiment during a bearish market leads to declines, and so on).

BGNE’s Financial Performance and Stock Valuation

BGNE’s financial performance directly influences its stock price. The following table presents the company’s revenue and earnings per share (EPS) for the last four quarters.

| Quarter | Revenue (USD Millions) | EPS (USD) | P/E Ratio |

|---|---|---|---|

| Q1 2024 | 500 | 2.00 | 25 |

| Q4 2023 | 450 | 1.80 | 28 |

| Q3 2023 | 400 | 1.50 | 30 |

| Q2 2023 | 350 | 1.20 | 35 |

Note: This is sample data for illustrative purposes only. Actual data should be obtained from a reliable financial source.

Generally, strong revenue growth and increasing EPS lead to higher stock prices, while declining financial performance often results in price decreases. BGNE’s current valuation includes a market capitalization of [Insert Market Cap – illustrative data] and a price-to-book ratio of [Insert P/B Ratio – illustrative data].

Risk Assessment of Investing in BGNE Stock

Investing in BGNE stock carries several inherent risks. Understanding these risks is crucial for informed investment decisions.

Three potential risks associated with investing in BGNE stock are:

- Clinical Trial Risk: Failure of clinical trials for new drug candidates can significantly impact the stock price. This is a common risk in the biotechnology industry.

- Regulatory Risk: Negative regulatory decisions regarding drug approvals or pricing can negatively affect BGNE’s revenue and stock valuation.

- Competition Risk: Intense competition from other pharmaceutical and biotechnology companies can impact market share and profitability.

The impact of these risks on BGNE’s stock price can be substantial. For example, a failed clinical trial could lead to a significant drop in the stock price, while strong competition could result in slower revenue growth and lower valuations.

Investors can mitigate these risks through:

- Diversification: Spreading investments across different asset classes and sectors to reduce overall portfolio risk.

- Thorough Due Diligence: Conducting comprehensive research on BGNE’s financials, pipeline, and competitive landscape before investing.

- Long-Term Investment Horizon: Holding BGNE stock for the long term can help reduce the impact of short-term volatility.

Future Outlook for BGNE Stock Price

Predicting BGNE’s stock price trajectory for the next year requires considering current market conditions and the company’s performance. Based on current trends and anticipated developments, the following predictions are offered (Note: These are illustrative predictions and should not be considered financial advice. Actual performance may vary significantly).

Considering the current market conditions and the company’s pipeline, a moderate increase in BGNE’s stock price is predicted for the next year. This prediction is based on the expectation of continued revenue growth driven by the successful commercialization of existing drugs and potential approvals of new drug candidates. However, the prediction also accounts for the inherent volatility of the biotech sector and potential setbacks in clinical trials or regulatory approvals.

Potential catalysts that could positively affect BGNE’s stock price include successful clinical trial results for new drug candidates, FDA approvals, and strategic partnerships. Negative catalysts could include setbacks in clinical trials, regulatory hurdles, or increased competition.

Potential scenarios and their corresponding impacts on BGNE’s stock price are:

- Scenario 1: Successful drug approvals and strong clinical trial data: Significant price increase.

- Scenario 2: Setbacks in clinical trials and regulatory delays: Significant price decrease.

- Scenario 3: Moderate revenue growth and stable market conditions: Moderate price increase or stability.

Quick FAQs

What is BGNE’s current market capitalization?

The current market capitalization of BGNE fluctuates and should be checked on a reputable financial website for the most up-to-date information.

Where can I find real-time BGNE stock price quotes?

Real-time quotes are available through major financial news websites and brokerage platforms.

What are the major competitors of BGNE?

This depends on the specific market segment BGNE operates within. Competitor information can be found through industry reports and financial databases.

Is BGNE currently profitable?

BGNE’s profitability varies from quarter to quarter. Refer to their financial reports for the most recent data.