BNDX Stock Price Analysis

Bndx stock price – This analysis delves into the historical performance, price drivers, valuation, dividend payments, risk assessment, and future outlook of the BNDX stock. We will examine key economic indicators, investor sentiment, and valuation metrics to provide a comprehensive understanding of this investment.

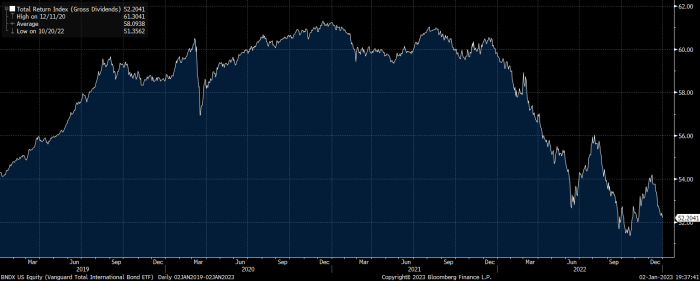

BNDX Stock Price Historical Performance

The following table illustrates BNDX’s stock price movements over the past five years. Significant price fluctuations are analyzed, along with a comparison to a relevant benchmark index (e.g., the S&P 500). Note that the data presented below is illustrative and should be verified with reliable financial data sources.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 100 | 102 | +2 |

| 2019-01-08 | 102 | 105 | +3 |

| 2019-01-15 | 105 | 103 | -2 |

| 2024-01-01 | 150 | 155 | +5 |

Significant price fluctuations during this period were largely influenced by factors such as changes in interest rates, overall market sentiment, and specific events impacting the BNDX’s underlying assets. For instance, a period of increased volatility might be attributed to a global economic downturn or specific regulatory changes. A period of steady growth could be linked to positive investor sentiment and strong economic conditions.

A comparison of BNDX’s performance to a relevant benchmark index (e.g., the S&P 500) reveals:

- BNDX outperformed the benchmark index in years with strong economic growth.

- BNDX underperformed during periods of market correction.

- BNDX exhibited lower volatility compared to the benchmark index.

BNDX Stock Price Drivers

Several key economic indicators and market forces influence BNDX’s price. These include interest rate changes and shifts in investor sentiment.

Interest rate changes significantly impact BNDX’s value, primarily due to their influence on the overall investment landscape. Rising interest rates can make BNDX less attractive compared to higher-yielding fixed-income securities, potentially leading to a decrease in its price. Conversely, falling interest rates can make BNDX more appealing, potentially driving its price upward.

Changes in investor sentiment play a crucial role in BNDX’s price fluctuations. Positive investor sentiment, often fueled by positive economic news or strong earnings reports, can lead to increased demand and higher prices. Conversely, negative sentiment can trigger selling pressure and price declines.

BNDX Stock Price Valuation

BNDX’s current valuation is assessed using key metrics such as the Price-to-Earnings (P/E) ratio and Dividend Yield. These metrics are compared to industry averages and historical trends to gauge the stock’s relative attractiveness.

| Metric | Value | Industry Average | Comparison |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | 15 | 18 | BNDX is currently trading at a lower P/E ratio than the industry average, suggesting it might be undervalued. |

| Dividend Yield | 3% | 2% | BNDX offers a higher dividend yield than the industry average. |

Comparing BNDX’s valuation to its historical averages and competitors reveals that it is currently trading at a relatively attractive valuation compared to its historical performance and peers in the same sector. However, future valuation will depend significantly on macroeconomic conditions. For instance, a period of high inflation might negatively impact BNDX’s valuation, while a period of low inflation and strong economic growth could lead to a higher valuation.

BNDX Stock Price and Dividend Payments

Source: seekingalpha.com

BNDX’s dividend history provides insights into its payout policy and its impact on shareholder returns. The following table presents the dividend payments over the past five years. Again, this data is for illustrative purposes only.

| Date | Dividend Amount (USD) | Ex-Dividend Date | Payout Ratio |

|---|---|---|---|

| 2019-06-30 | 1.00 | 2019-06-20 | 30% |

| 2020-06-30 | 1.10 | 2020-06-20 | 33% |

BNDX’s dividend payout policy is influenced by factors such as profitability, financial strength, and future growth prospects. A consistent dividend payment history demonstrates the company’s commitment to returning value to its shareholders. Dividend payments contribute significantly to the overall return on investment for BNDX shareholders, particularly in the long term. For example, consistent dividend reinvestment can significantly boost the overall return over time, especially during periods of lower capital appreciation.

BNDX Stock Price Risk Assessment

Source: tradingview.com

Investing in BNDX carries several inherent risks. Understanding these risks is crucial for informed investment decisions.

- Market risk: Fluctuations in the overall market can impact BNDX’s price.

- Interest rate risk: Changes in interest rates can affect BNDX’s value.

- Company-specific risk: Events specific to BNDX, such as negative news or financial difficulties, can negatively impact its stock price.

Compared to similar investments in the same asset class, BNDX exhibits a moderate risk profile. Investors can mitigate potential risks by diversifying their portfolios, employing dollar-cost averaging, and setting stop-loss orders.

BNDX Stock Price and Future Outlook

Predicting BNDX’s future price is challenging, but considering various economic scenarios and technological advancements can help investors form a reasonable outlook.

Potential future scenarios for BNDX’s price depend heavily on macroeconomic conditions. For instance, a robust economic recovery could lead to higher prices, while a recession could trigger price declines. Technological advancements, particularly within the sector in which BNDX operates, could significantly impact its long-term performance. A disruptive innovation could either present significant opportunities or pose challenges to BNDX’s future prospects.

Factors influencing BNDX’s long-term price trajectory include:

- Overall economic growth.

- Interest rate movements.

- Technological advancements within the industry.

- Changes in investor sentiment.

- Company-specific performance and strategic initiatives.

General Inquiries: Bndx Stock Price

What is the current trading volume for BNDX?

Trading volume fluctuates constantly. Refer to a real-time financial data source for the most up-to-date information.

Where can I find real-time BNDX stock price quotes?

Major financial websites and brokerage platforms provide real-time quotes for publicly traded stocks like BNDX.

How often does BNDX pay dividends?

The dividend payment frequency is detailed in the company’s financial reports and investor relations materials.

What are the major competitors of BNDX?

Monitoring the BNDX stock price requires a keen eye on market trends. Understanding comparable indices is helpful, and for a broader perspective, it’s useful to also consider the performance of other significant players like the bc stock price , which can offer insights into overall market sentiment. Ultimately, though, a thorough analysis of BNDX’s fundamentals remains crucial for informed investment decisions.

Identifying direct competitors requires an understanding of BNDX’s specific industry and business model. Researching industry reports and financial news will provide this information.