Bristol Myers Squibb: A Deep Dive into Stock Performance: Bristol-myers Stock Price

Bristol-myers stock price – Bristol Myers Squibb (BMS) is a prominent player in the pharmaceutical industry, renowned for its innovative therapies and substantial market presence. This analysis explores the key factors influencing BMS’s stock price, examining its financial performance, investor sentiment, and future prospects. We will delve into the company’s history, product portfolio, competitive landscape, and risk factors to provide a comprehensive understanding of its investment potential.

Bristol Myers Squibb Company Overview

Bristol Myers Squibb emerged from the merger of Bristol-Myers Company and Squibb Corporation in 1989. Since then, it has established itself as a global biopharmaceutical leader, consistently developing and commercializing innovative medicines. The company’s history is marked by significant acquisitions and a focus on oncology, cardiovascular disease, immunology, and fibrosis.

Major Product Lines and Therapeutic Areas

BMS’s product portfolio is diverse, spanning various therapeutic areas. Key products include Opdivo (nivolumab), a leading immunotherapy for cancer; Revlimid (lenalidomide), a treatment for multiple myeloma; and Eliquis (apixaban), a blood thinner. These drugs, along with others in the pipeline, generate substantial revenue and contribute significantly to the company’s market position.

Analyzing Bristol-Myers Squibb’s stock price requires a multifaceted approach, considering various market factors. It’s helpful to compare its performance against other pharmaceutical companies, and even contrasting sectors, such as observing the trends in a completely different market like the bit stock price , can offer interesting comparative insights. Ultimately, understanding Bristol-Myers’ trajectory necessitates a broader market perspective.

Current Market Position and Competitive Landscape

BMS operates in a highly competitive market characterized by intense R&D and patent challenges. The company faces competition from large pharmaceutical companies like Pfizer, Merck, and Roche, along with numerous smaller biotech firms. Despite this, BMS maintains a strong market position, particularly in oncology, thanks to its innovative therapies and robust sales and marketing capabilities. Its strategic acquisitions and licensing agreements also play a crucial role in maintaining its competitive edge.

Research and Development Pipeline

BMS invests heavily in research and development, aiming to discover and develop new therapies to address unmet medical needs. The company’s pipeline includes several promising candidates in various stages of clinical development, focusing on areas such as oncology, immunology, and cardiovascular diseases. The success of these clinical trials significantly impacts the company’s future growth prospects and stock valuation.

Factors Influencing Bristol Myers Squibb Stock Price

Several factors influence BMS’s stock price, ranging from macroeconomic conditions to company-specific events. Understanding these influences is crucial for investors seeking to assess the investment potential of BMS stock.

Macroeconomic Factors

Interest rate changes, inflation, and overall economic growth significantly impact the pharmaceutical industry, influencing investor sentiment and risk appetite. High interest rates can increase borrowing costs for BMS, potentially affecting its investments in R&D and acquisitions. Inflation can impact input costs and pricing strategies. Economic downturns can reduce healthcare spending, affecting demand for pharmaceutical products.

Regulatory Changes

Regulatory approvals and changes in healthcare policies significantly influence BMS’s stock price. Successful drug approvals lead to increased revenue potential, while regulatory setbacks can negatively impact the company’s valuation. Changes in pricing regulations and reimbursement policies also affect profitability and investor confidence.

Competitor Performance

Source: thestreet.com

The performance of BMS’s competitors directly impacts its market share and stock price. Successful launches of competing drugs or innovative technologies by rivals can erode BMS’s market share and reduce its revenue growth. Conversely, setbacks faced by competitors can present opportunities for BMS to gain market share.

Clinical Trial Results

The results of major clinical trials are pivotal in determining the success or failure of new drug candidates. Positive clinical trial data can significantly boost investor confidence and drive up the stock price. Conversely, negative or inconclusive results can lead to a decline in the stock price.

Financial Performance and Stock Valuation

Analyzing BMS’s financial performance and employing various stock valuation methods provides a more comprehensive understanding of its intrinsic value and investment potential.

Key Financial Metrics (Last Five Years – Illustrative Data)

| Year | Revenue (Billions USD) | Net Income (Billions USD) | EPS (USD) |

|---|---|---|---|

| 2018 | 19.3 | 4.8 | 3.10 |

| 2019 | 20.2 | 5.2 | 3.35 |

| 2020 | 21.5 | 6.0 | 3.80 |

| 2021 | 22.9 | 6.5 | 4.15 |

| 2022 | 24.1 | 7.0 | 4.50 |

Note: This data is illustrative and should not be considered actual financial data. Investors should refer to official financial statements for accurate information.

Revenue and Earnings Growth

A line graph would visually represent the revenue and earnings growth over the past five years. The graph would show an upward trend, illustrating the company’s growth trajectory. The y-axis would represent revenue and earnings in billions of USD, while the x-axis would represent the years. The graph would clearly demonstrate the overall financial health and performance of BMS.

Debt Levels and Credit Rating

BMS maintains a certain level of debt to finance its operations and acquisitions. The company’s credit rating, provided by agencies like Moody’s and S&P, reflects its creditworthiness and financial stability. A strong credit rating signifies lower risk and can influence investor confidence.

Stock Valuation Methods

Various valuation methods, such as discounted cash flow (DCF) analysis, comparable company analysis, and price-to-earnings (P/E) ratio analysis, can be applied to estimate BMS’s intrinsic value. Each method provides a different perspective, and a comprehensive analysis using multiple methods offers a more robust valuation.

Investor Sentiment and Market Outlook

Understanding investor sentiment and market outlook is crucial for assessing the potential future performance of BMS stock.

Recent Investor Sentiment

Investor sentiment towards BMS is often influenced by factors like clinical trial results, regulatory approvals, and competitive developments. Positive news generally leads to increased buying pressure, while negative news can trigger selling.

Analyst Ratings and Price Targets

Financial analysts provide ratings and price targets for BMS stock based on their assessments of the company’s financial performance, growth prospects, and risk factors. These ratings and price targets can influence investor decisions and provide valuable insights into market expectations.

Major News Events

Major news events, such as significant clinical trial results, FDA approvals, or large acquisitions, can have a substantial impact on BMS’s stock price. These events can cause short-term volatility, but their long-term impact depends on their implications for the company’s future growth and profitability.

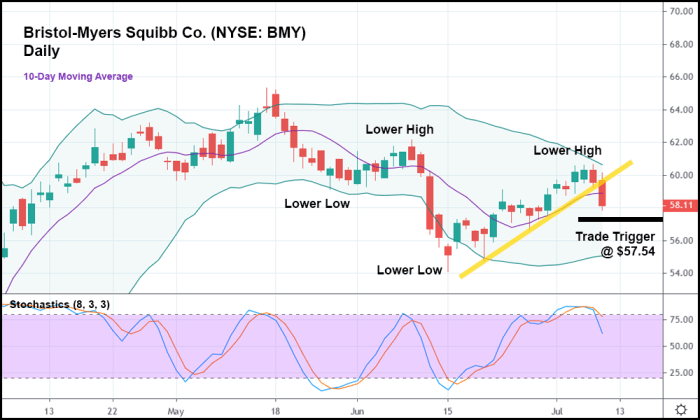

Candlestick Chart Interpretation

Analyzing candlestick charts can reveal potential trends and patterns in BMS’s stock price. For example, bullish engulfing patterns may suggest a potential upward trend, while bearish engulfing patterns may indicate a potential downward trend. However, it is crucial to remember that technical analysis should be used in conjunction with fundamental analysis for a comprehensive assessment.

Risk Assessment and Potential Opportunities

Source: investors.com

Like any pharmaceutical company, BMS faces several risks, but also has potential growth opportunities.

Potential Risks

Patent expirations for key drugs pose a significant risk to BMS’s revenue streams. Increased competition from generic drugs and innovative therapies developed by competitors can also erode market share and profitability. Regulatory hurdles and adverse clinical trial results also represent substantial risks.

Growth Opportunities, Bristol-myers stock price

Successful launches of new drugs in the pipeline offer significant growth opportunities. Expanding into new markets and therapeutic areas, as well as strategic acquisitions and partnerships, can further fuel growth. Advances in biotechnology and personalized medicine could also present new avenues for growth.

Risk Profile Comparison

BMS’s risk profile can be compared to that of other pharmaceutical companies based on factors such as patent cliff exposure, pipeline strength, and competitive intensity. A comparative analysis can provide insights into the relative risk and return potential of investing in BMS versus its peers.

Impact of Emerging Technologies

Source: unseenopp.com

Emerging technologies such as artificial intelligence (AI) and big data analytics are transforming the pharmaceutical industry. BMS’s ability to effectively leverage these technologies for drug discovery, development, and commercialization will significantly impact its future competitiveness and growth.

FAQs

What are the major risks associated with investing in Bristol-Myers Squibb stock?

Major risks include patent expirations on key drugs, competition from other pharmaceutical companies, regulatory hurdles, and the inherent volatility of the pharmaceutical market.

How does Bristol-Myers Squibb compare to its competitors in terms of market capitalization and revenue?

A direct comparison requires researching current market data. Look at financial news sites for up-to-date information on market capitalization and revenue figures for Bristol Myers Squibb and its major competitors.

What is Bristol-Myers Squibb’s dividend payout ratio?

The dividend payout ratio can be found in their financial reports and on financial news websites. This ratio shows the proportion of earnings paid out as dividends.

Where can I find reliable financial data for Bristol-Myers Squibb?

Reliable data is available on the company’s investor relations website, major financial news sources (e.g., Bloomberg, Yahoo Finance), and the SEC’s EDGAR database.