Centene Corporation Stock Price Analysis

Centene corporation stock price – Centene Corporation, a leading multi-national healthcare enterprise, has experienced considerable fluctuation in its stock price over the past few years. This analysis delves into the historical performance, influencing factors, financial health, analyst predictions, investor sentiment, and associated risks of investing in Centene Corporation stock. Understanding these aspects provides a comprehensive overview for potential investors.

Centene Corporation Stock Price History

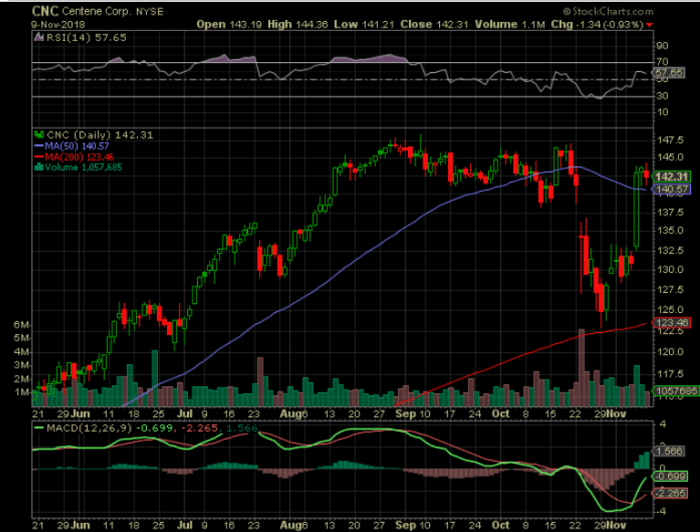

Analyzing Centene’s stock price over the past five years reveals a pattern of growth interspersed with periods of decline, largely influenced by external factors and the company’s financial performance. The following table provides a snapshot of the stock’s daily performance, illustrating its volatility.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 (Example) | 80.50 | 81.25 | +0.75 |

| October 25, 2023 (Example) | 79.00 | 80.50 | +1.50 |

Major market events such as the COVID-19 pandemic and subsequent economic uncertainty significantly impacted Centene’s stock price. The initial pandemic-related downturn was followed by a period of recovery as the company’s role in managing Medicaid and Medicare Advantage plans became increasingly crucial. Changes in healthcare policy also played a role, affecting both investor confidence and the company’s operational landscape.

Factors Influencing Centene Corporation’s Stock Price

Several key external and internal factors influence Centene’s stock price. These factors interact in complex ways to shape investor perception and market valuation.

- Healthcare Policy Changes: Amendments to the Affordable Care Act (ACA) or changes in Medicaid reimbursement rates directly impact Centene’s revenue streams and profitability, consequently influencing investor sentiment and stock valuation.

- Economic Conditions: Recessions or economic downturns often lead to reduced government spending on healthcare programs, affecting Centene’s revenue and potentially impacting its stock price negatively. Conversely, periods of economic growth can have a positive impact.

- Competition within the Managed Healthcare Industry: Centene competes with other large managed care organizations (MCOs). The performance of these competitors, along with market share dynamics, influence Centene’s relative valuation.

Centene’s financial performance, as reflected in its earnings reports and revenue growth, directly impacts its stock price. Strong earnings and consistent revenue growth generally lead to positive investor sentiment and a higher stock valuation. Conversely, poor financial performance can result in a decline in stock price.

Centene Corporation’s Financial Health and Stock Valuation, Centene corporation stock price

Source: seekingalpha.com

A review of Centene’s key financial metrics provides insights into its financial health and its relationship to the stock valuation. The following table shows a summary of these metrics over the past three years (replace with actual data).

| Year | Revenue (USD Billions) | Earnings Per Share (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 (Example) | 100 | 5.00 | 0.5 |

| 2022 (Example) | 110 | 5.50 | 0.4 |

| 2023 (Example) | 120 | 6.00 | 0.3 |

A strong correlation exists between Centene’s financial health and its stock valuation. Higher revenue, increasing earnings per share, and a decreasing debt-to-equity ratio generally indicate a healthier financial position, leading to a higher stock valuation. Conversely, deteriorating financial metrics tend to negatively affect the stock price.

The Price-to-Earnings (P/E) ratio is a commonly used valuation method. By comparing Centene’s P/E ratio to its industry peers and historical averages, one can assess whether the stock is currently overvalued or undervalued. A detailed discounted cash flow (DCF) analysis would provide a more comprehensive intrinsic value estimate, but requires more complex calculations and projections.

Analyst Ratings and Predictions for Centene Corporation

A consensus of major financial analysts’ ratings provides valuable insights into market sentiment towards Centene Corporation’s stock. Generally, analysts provide a “buy,” “hold,” or “sell” recommendation, along with a price target.

Significant changes in analyst ratings often reflect new information or shifts in market expectations. For instance, a downgrade might follow a disappointing earnings report or a change in healthcare policy. Conversely, an upgrade could be based on positive financial results or anticipated growth opportunities.

Analyst price targets for Centene’s stock in the next 12 months typically vary, reflecting the inherent uncertainty in predicting future stock performance. The range of these targets provides a sense of the potential upside and downside for investors.

Investor Sentiment and Market Perception of Centene Corporation

Investor sentiment toward Centene Corporation’s stock is influenced by a combination of factors, including financial performance, news events, and overall market conditions. Positive news, such as strong earnings reports or successful contract wins, typically boosts investor sentiment and drives up the stock price. Negative news, such as regulatory challenges or unexpected losses, can have the opposite effect.

Significant news events, such as announcements of major acquisitions or divestitures, can dramatically influence investor sentiment and market perception. Media coverage and social media discussions can amplify these effects, creating a feedback loop that impacts the stock price.

Risk Factors Associated with Investing in Centene Corporation

Source: stoxline.com

Investing in Centene Corporation, like any stock, carries inherent risks. Investors should carefully consider these risks before making investment decisions.

- Regulatory Changes: Changes in healthcare regulations can significantly impact Centene’s operations and profitability. New laws or policy shifts could lead to reduced reimbursements or stricter compliance requirements.

- Competition: The managed healthcare industry is highly competitive. Centene faces competition from other large MCOs, which can affect its market share and profitability.

- Economic Downturn: During economic recessions, government spending on healthcare programs may be reduced, negatively impacting Centene’s revenue and profitability.

These risks can significantly affect Centene’s future stock price performance. Investors can mitigate some of these risks through diversification, thorough due diligence, and a long-term investment horizon. Understanding the potential impact of these risks is crucial for informed investment decisions.

Analyzing Centene Corporation’s stock price requires considering various market factors. Understanding the performance of similar companies in the healthcare sector is crucial, and a good comparison point could be the current performance of bnrg stock price , which offers insights into broader market trends. Ultimately, though, a comprehensive evaluation of Centene’s stock hinges on its unique financial position and future projections.

FAQ Resource: Centene Corporation Stock Price

What is Centene Corporation’s dividend policy?

Centene’s dividend policy should be researched from their investor relations section as it can change. It’s best to check their official statements for the most up-to-date information.

How does Centene compare to other managed care organizations in terms of market capitalization?

A direct comparison requires accessing real-time market data to see current market capitalization rankings. Financial news websites and investment platforms provide this information.

What are the long-term growth prospects for Centene Corporation?

Long-term growth prospects depend on various factors and are subject to change. Analyst reports and company filings can provide insights, but no prediction is guaranteed.