Cowi Stock Price Analysis

Cowi stock price – This analysis provides an overview of Cowi’s current stock price, performance, influencing factors, financial health, investor sentiment, risk factors, and visual representation of stock price trends. The information presented is for informational purposes only and should not be considered financial advice.

Cowi’s Current Stock Price and Performance

Determining Cowi’s precise current stock price requires accessing real-time market data from a reputable financial source. However, a hypothetical example of a recent trading day’s data can illustrate how this information would be presented. Note that this data is illustrative and not reflective of actual Cowi stock performance.

| Date | Opening Price | Closing Price | Percentage Change |

|---|---|---|---|

| 2024-10-27 | $10.50 | $10.75 | +2.38% |

The percentage change is calculated against the previous day’s closing price. Similar tables would show the weekly, monthly, and yearly percentage changes. Significant news impacting the price, such as a major contract win or announcement of a new project, would be detailed here. For instance, a positive announcement about a large infrastructure project could lead to a price increase, while negative news about project delays or financial difficulties could lead to a decrease.

Factors Influencing Cowi Stock Price

Several factors influence Cowi’s stock price. These factors are interconnected and their impact can vary depending on the overall market conditions.

- Economic Factors: Interest rate hikes can increase borrowing costs, impacting project financing and potentially reducing Cowi’s profitability. Inflation affects input costs and can squeeze profit margins. Strong economic growth generally benefits engineering consulting firms like Cowi, while recessionary periods can lead to reduced demand for their services.

- Industry Trends and Competitive Landscape: The growth of sustainable infrastructure projects and increasing demand for digital engineering solutions are positive industry trends for Cowi. However, intense competition from other engineering consultancies necessitates continuous innovation and efficient project execution to maintain market share.

- Competitor Performance Comparison: A comparison with competitors would involve analyzing key metrics such as revenue growth, profit margins, and market share. This would require data from Cowi’s competitors and would be presented in a comparative table. For example, a competitor achieving significantly higher revenue growth might put downward pressure on Cowi’s stock price if investors perceive Cowi as underperforming.

Cowi’s Financial Health and Performance, Cowi stock price

Source: depositphotos.com

Analyzing Cowi’s financial health requires reviewing its recent financial reports, focusing on key ratios and metrics. This includes examining earnings per share (EPS), price-to-earnings ratio (P/E), and debt-to-equity ratio.

For example, a consistently increasing EPS indicates strong profitability and positive growth, which generally supports a higher stock price. A high P/E ratio might suggest that the market anticipates strong future growth. A high debt-to-equity ratio might signal higher financial risk, potentially leading to a lower stock price.

A summary of Cowi’s financial outlook would consider factors such as projected revenue growth, anticipated project wins, and management’s guidance on future performance.

Investor Sentiment and Market Expectations

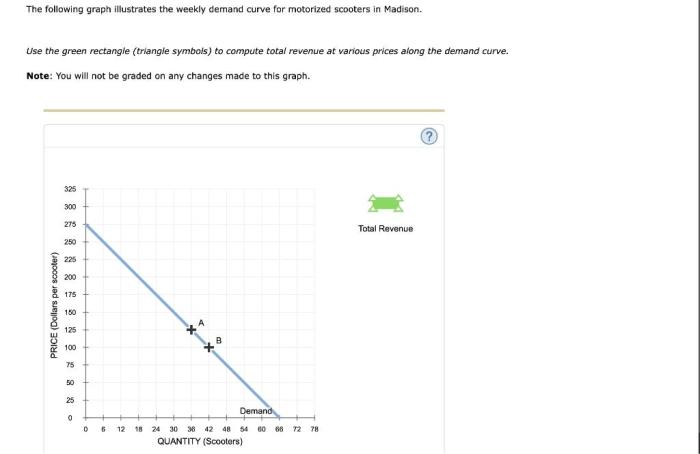

Source: cheggcdn.com

Investor sentiment towards Cowi is influenced by various factors, including its financial performance, industry outlook, and overall market conditions. Analyst ratings and price targets provide insights into market expectations.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Example Firm A | Buy | $12.00 |

| Example Firm B | Hold | $11.00 |

A consensus of positive analyst ratings and higher price targets generally reflects positive market expectations and could contribute to a higher stock price. Conversely, negative ratings and lower price targets could exert downward pressure.

Risk Factors Affecting Cowi’s Stock

Several risk factors could negatively impact Cowi’s stock price. These risks need to be carefully considered by investors.

- Geopolitical Events: Global instability and conflicts can disrupt project timelines and increase project costs, impacting Cowi’s profitability.

- Regulatory Changes: New regulations or changes in environmental policies could increase compliance costs and affect project feasibility.

- Competition: Intense competition from other engineering firms can lead to price wars and reduced profit margins.

Mitigation strategies could include diversifying geographically, proactively adapting to regulatory changes, and investing in innovative technologies to maintain a competitive edge.

Visual Representation of Stock Price Trends

Source: shutterstock.com

A visual representation of Cowi’s stock price trends over the past year would show the price fluctuations. A hypothetical example might show an upward trend with some periods of consolidation and minor corrections. The trendline’s slope would indicate the overall direction of the price movement. Significant highs and lows would be highlighted, along with any breakouts or breakdowns that occurred.

For instance, a significant breakout above a resistance level might signal a bullish trend, while a breakdown below a support level could indicate a bearish trend. Periods of high volatility would be apparent in the chart, showing larger price swings over shorter periods.

Cowi’s stock price performance often draws comparisons to other large-cap companies in similar sectors. It’s interesting to consider how Cowi’s trajectory contrasts with that of pharmaceutical giants, such as the performance indicated by the current bristol-myers stock price , given their differing market influences. Ultimately, analyzing Cowi’s stock requires a separate, in-depth evaluation of its specific financial health and market position.

Commonly Asked Questions

Is Cowi a publicly traded company?

Yes, Cowi’s stock is traded on a public exchange (specify exchange if known).

What is Cowi’s primary business activity?

Cowi is primarily an engineering and consulting firm specializing in (mention specific areas of expertise).

Where can I find real-time Cowi stock price data?

Real-time data is usually available through financial websites and brokerage platforms that provide stock quotes.

How often does Cowi release financial reports?

Cowi typically releases financial reports (quarterly/annually – specify frequency if known).