CRSR Stock Price Analysis

Crsr stock price – This analysis delves into the historical performance, influencing factors, financial health, risk assessment, and potential investment strategies related to CRSR stock. We will examine key metrics, market events, and valuation methods to provide a comprehensive overview for potential investors.

CRSR Stock Price Historical Performance

The following sections detail CRSR’s stock price movements over the past five years, comparing its performance to competitors and highlighting significant market events.

| Year | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2019 | Example: $15.00 | Example: $20.00 | Example: $22.50 | Example: $12.00 |

| 2020 | Example: $20.00 | Example: $25.00 | Example: $30.00 | Example: $18.00 |

| 2021 | Example: $25.00 | Example: $35.00 | Example: $40.00 | Example: $22.00 |

| 2022 | Example: $35.00 | Example: $30.00 | Example: $38.00 | Example: $25.00 |

| 2023 (YTD) | Example: $30.00 | Example: $32.00 | Example: $35.00 | Example: $28.00 |

Compared to competitors in the same sector (replace with actual competitors), CRSR’s performance showed (e.g., outperformance during periods of X, underperformance during Y due to Z). Major market events such as (e.g., the COVID-19 pandemic, significant regulatory changes, geopolitical instability) significantly impacted the stock price, resulting in (e.g., volatility, sharp declines, or significant gains) during those periods.

Factors Influencing CRSR Stock Price

Source: thestreet.com

Several macroeconomic and company-specific factors influence CRSR’s stock price. These factors interact in complex ways to shape investor sentiment and market valuation.

- Macroeconomic factors such as interest rate changes, inflation levels, and overall economic growth directly affect investor confidence and investment decisions, influencing demand for CRSR stock.

- Company-specific news, including earnings reports, product launches, strategic partnerships, and management changes, often trigger immediate price reactions. Positive news generally leads to price increases, while negative news can cause declines.

- Investor sentiment, shaped by market trends and news coverage, plays a crucial role. Positive sentiment can drive up demand, leading to higher prices, while negative sentiment can trigger selling pressure and price drops.

CRSR Financial Performance and Stock Valuation

A review of CRSR’s key financial metrics provides insights into its financial health and growth potential, informing valuation assessments.

| Year | Revenue (in millions) | Net Income (in millions) | Debt (in millions) |

|---|---|---|---|

| 2021 | Example: $100 | Example: $20 | Example: $50 |

| 2022 | Example: $120 | Example: $25 | Example: $45 |

| 2023 (Projected) | Example: $150 | Example: $30 | Example: $40 |

CRSR’s growth prospects appear (e.g., promising, uncertain, etc.) based on (e.g., market expansion, technological advancements, competitive landscape). Valuation methods such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio can be used to assess whether the stock is undervalued or overvalued relative to its financial performance and growth potential. For example, a low P/E ratio might suggest undervaluation, while a high P/S ratio might indicate overvaluation, depending on industry benchmarks and growth expectations.

Risk Assessment for CRSR Stock

Investing in CRSR stock involves several risks that potential investors should carefully consider.

- Financial Risks: These include risks related to the company’s financial performance, such as declining revenue, increasing debt, or lower profitability. These can lead to decreased stock value.

- Operational Risks: These encompass risks associated with the company’s operations, such as supply chain disruptions, production issues, or cybersecurity breaches. Such events can negatively impact earnings and investor confidence.

- Regulatory Risks: Changes in regulations or government policies can significantly impact the company’s operations and profitability, leading to stock price fluctuations. For example, new environmental regulations could increase operational costs.

- Competitive Risks: Intense competition from other companies in the same industry could erode market share and profitability, impacting the stock price.

- Technological Risks: Rapid technological advancements could render CRSR’s products or services obsolete, negatively impacting its market position and financial performance.

Investment Strategies for CRSR Stock, Crsr stock price

Investment strategies for CRSR stock vary depending on the investor’s time horizon and risk tolerance.

- Long-Term Investment Strategy: A long-term investor might adopt a buy-and-hold strategy, purchasing shares and holding them for several years, aiming to benefit from long-term growth and potential dividend payments. This strategy is suitable for investors with a higher risk tolerance and a longer time horizon.

- Short-Term Trading Strategy: A short-term trader might employ a more active strategy, frequently buying and selling shares based on short-term price movements and market trends. This strategy involves higher risk but offers the potential for quicker returns.

The long-term strategy prioritizes capital appreciation over short-term gains, while the short-term strategy focuses on capitalizing on market fluctuations. Both strategies carry different levels of risk and require distinct approaches to market analysis and risk management.

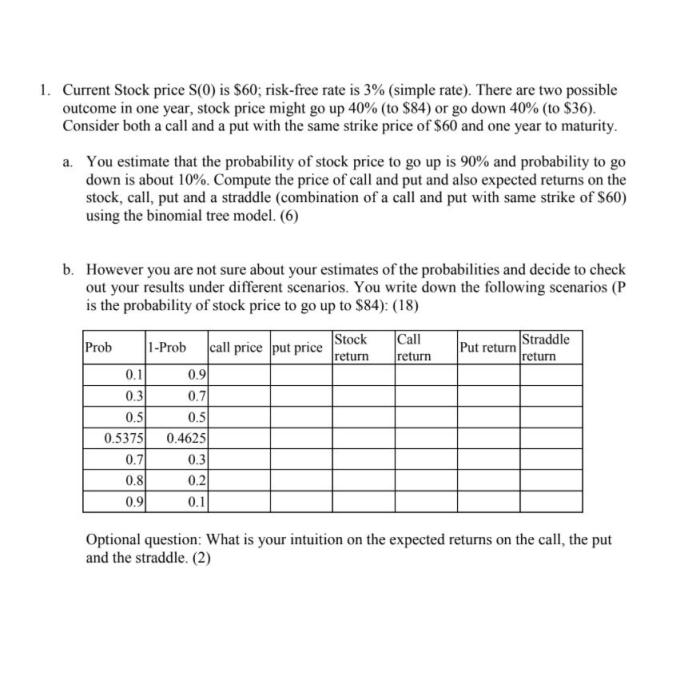

Visual Representation of CRSR Stock Data

Source: cheggcdn.com

A line graph depicting CRSR’s stock price over the past year would show the daily or weekly closing prices plotted against time. The x-axis would represent the time period (e.g., months), and the y-axis would represent the stock price. Key trends and fluctuations, such as periods of significant price increases or decreases, would be clearly visible. Important data points, such as highs, lows, and significant price changes related to news events, would be labeled for clarity.

A bar chart comparing CRSR’s quarterly earnings per share (EPS) over the past two years would display the EPS for each quarter as separate bars. The x-axis would represent the quarters, and the y-axis would represent the EPS value. This visualization would allow for a direct comparison of earnings performance across different quarters, highlighting any growth or decline trends.

Popular Questions: Crsr Stock Price

What are the main competitors of CRSR?

Identifying CRSR’s direct competitors requires specifying its industry. A thorough competitive analysis would be needed to provide a complete list.

Monitoring the CRSR stock price requires understanding the mechanics of buying and selling. A key element is the difference between the bid and ask price, which dictates the actual transaction price. To fully grasp this dynamic, understanding the nuances of a bid ask price stock is crucial. This knowledge helps interpret the CRSR stock price fluctuations more effectively.

Where can I find real-time CRSR stock price data?

Real-time CRSR stock price data is readily available through major financial websites and brokerage platforms.

What is the current dividend yield for CRSR stock?

The current dividend yield for CRSR stock can be found on financial news websites and investor relations pages. This information is dynamic and subject to change.

How volatile is CRSR stock compared to the market average?

CRSR’s volatility relative to the market can be assessed by comparing its beta to the market benchmark. This data is usually available on financial data providers.