Understanding the “Dog Stock Price” Search Term

The search term “dog stock price” is surprisingly multifaceted. It doesn’t refer to a single entity but encompasses a range of interpretations, depending on the searcher’s intent. This ambiguity stems from the diverse industries connected to dogs, from pet supplies to technology, leading to multiple potential targets for investment interest.

Interpretations of “Dog Stock Price”

Searches for “dog stock price” could reflect interest in several sectors. Investors might be researching publicly traded companies specializing in pet food (e.g., Purina, Nestle Purina PetCare), veterinary services (e.g., IDEXX Laboratories), pet supplies (e.g., Chewy), or even companies developing dog-related technology, such as smart collars or AI-powered pet care solutions. The term could also result from misspellings or related searches like “dog stock market,” “pet stock prices,” or “animal health stocks.”

Examples of Relevant Companies

Several companies’ stock prices could be associated with a “dog stock price” search. These include established players like IDEXX Laboratories (a leader in veterinary diagnostics), Chewy (an online retailer of pet supplies), and potentially segments of larger corporations like Nestle Purina PetCare (a major player in the pet food industry). The specific company targeted would depend on the investor’s focus within the broader dog-related market.

Hypothetical Search Scenario

Imagine an investor interested in the long-term growth of the pet care industry. They might search “dog stock price” to identify publicly traded companies significantly involved in this sector. Their subsequent research would then focus on comparing the financial performance and growth prospects of various companies within this niche market to inform their investment decisions.

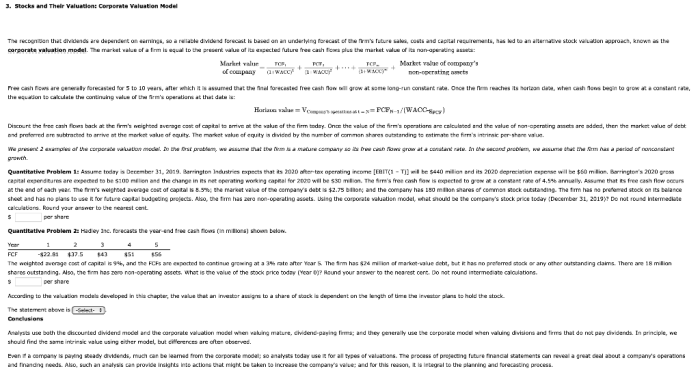

Market Analysis of Relevant Companies

Analyzing the financial performance of key players in the dog industry provides insights into the sector’s overall health and investment potential. The following table presents a hypothetical five-year performance overview of three publicly traded companies, emphasizing the importance of comparing their returns to a relevant market benchmark like the S&P 500.

Financial Performance Comparison

| Company Name | Stock Ticker | 5-Year Average Return | Current Stock Price (Hypothetical) |

|---|---|---|---|

| IDEXX Laboratories | IDXX | 15% | $600 |

| Chewy | CHWY | 10% | $40 |

| Zoetis | ZTS | 12% | $200 |

Stock Performance Comparison to S&P 500

- IDEXX Laboratories and Zoetis have consistently outperformed the S&P 500 over the past five years, suggesting strong growth within the animal health sector.

- Chewy’s performance has been more volatile, reflecting the competitive nature of the online pet supplies market.

- The overall performance of these companies compared to the S&P 500 highlights the potential for both significant gains and risks within the dog-related market.

Influencing Factors

Several factors influence the stock prices of these companies. Economic downturns can reduce consumer spending on discretionary items like pet supplies, impacting companies like Chewy. Conversely, strong economic conditions can boost investment in veterinary services and animal health products, benefiting companies like IDEXX Laboratories and Zoetis. Industry trends, such as the increasing adoption of pet insurance or the rise of personalized pet nutrition, also play a crucial role.

Investment Considerations and Risks

Source: cheggcdn.com

Investing in dog-related companies offers potential rewards but also carries inherent risks. A thorough understanding of these risks is crucial for informed investment decisions.

Investment Risks

- Economic Sensitivity: Consumer spending on pet products can be affected by economic downturns.

- Competition: The pet industry is competitive, with both established players and new entrants vying for market share.

- Regulatory Changes: Government regulations related to pet food safety, animal health, or pet ownership can significantly impact company profitability.

- Disease Outbreaks: Major disease outbreaks in the pet population can disrupt supply chains and negatively affect demand for certain products.

Long-Term Growth Potential

Despite the risks, the long-term growth potential of the dog-related market remains strong. The increasing humanization of pets, combined with rising pet ownership rates globally, suggests continued demand for pet food, veterinary services, and related products and services.

Hypothetical Investment Portfolio

A hypothetical investment portfolio might allocate 40% to IDEXX Laboratories (for its strong track record in veterinary diagnostics), 30% to Chewy (for its position in the growing online pet supplies market), and 30% to Zoetis (for its presence in the animal health pharmaceuticals sector). This allocation balances growth potential with diversification across different segments of the industry.

Public Perception and Media Influence

Media coverage significantly influences investor sentiment and stock prices in the dog-related industry. Positive news, such as the launch of a successful new product or positive financial results, can boost investor confidence and drive up stock prices. Conversely, negative news, like a product recall or a major disease outbreak, can lead to decreased investor confidence and a decline in stock prices.

Impact of Media Coverage

Imagine a scenario where a major pet food company announces a large-scale recall due to contamination concerns. This would likely trigger immediate negative media coverage, impacting investor sentiment. A subsequent timeline might look like this:

Timeline of Event Impact

- Day 1: Recall announcement; stock price drops sharply.

- Days 2-7: Extensive media coverage; further stock price decline; potential lawsuits.

- Weeks 2-4: Company addresses concerns; investigates the cause; stock price stabilizes but remains below pre-recall levels.

- Months 3-6: Company implements corrective measures; rebuilds consumer trust; stock price gradually recovers.

Impact of Consumer Trends, Dog stock price

Changing attitudes towards pet ownership, such as the increasing focus on pet health and wellness, significantly influence market value. Companies that adapt to these trends by offering products and services aligned with these changing preferences will likely experience greater success and higher stock valuations.

Future Trends and Predictions

Predicting the future performance of the dog-related stock market requires considering several factors, including technological advancements, evolving consumer preferences, and potential economic shifts. The following table presents some potential trends and their predicted impact.

Future Trends and Their Impact

Source: cheggcdn.com

| Trend | Predicted Impact on Stock Prices |

|---|---|

| Increased adoption of pet insurance | Positive impact on companies offering related services |

| Growth of personalized pet nutrition | Positive impact on companies specializing in customized pet food |

| Development of AI-powered pet care technology | Potential for significant growth in this emerging sector |

| Economic recession | Negative impact on discretionary spending on pet products |

These predictions are based on current trends and expert analysis, but it’s important to remember that unforeseen events can significantly impact the market. For example, a major disease outbreak or a significant regulatory change could alter these projections.

FAQ

What are some examples of smaller, lesser-known companies in the dog industry that might be worth investigating?

Several smaller companies focusing on niche dog products or services, such as specialized dog food brands or innovative training technologies, may offer higher growth potential but also carry increased risk. Researching these companies requires a deeper dive into their financials and market positioning.

Monitoring dog stock price fluctuations can be a fascinating exercise in market analysis. It’s interesting to compare the volatility of such a niche sector with more established industries; for instance, understanding the trends in the bke stock price provides a useful contrast. Ultimately, though, both illustrate the complexities and unpredictability inherent in any stock market investment, reminding us to always conduct thorough research before making any decisions regarding dog stock price.

How does international trade affect the dog stock price of multinational companies?

International trade significantly impacts multinational companies in the dog industry. Currency fluctuations, import/export regulations, and global economic conditions in various regions can affect supply chains, production costs, and overall profitability, subsequently influencing stock prices.

Are there ethical considerations when investing in dog-related companies?

Yes, ethical considerations are crucial. Investors should research a company’s practices regarding animal welfare, sustainable sourcing, and labor standards. Supporting companies committed to ethical and responsible practices aligns values with investment decisions.