Extra Space Storage Stock Price Analysis

Source: finbold.com

Extra space storage stock price – Extra Space Storage (EXR) is a prominent player in the self-storage industry, boasting a significant market presence and a history of growth. This analysis delves into the company’s business model, competitive landscape, financial performance, and future prospects to provide a comprehensive understanding of its stock price behavior and investment potential.

Extra Space Storage Company Overview, Extra space storage stock price

Extra Space Storage operates a portfolio of self-storage facilities across the United States, catering primarily to individual and small business customers needing short-term and long-term storage solutions. Their business model relies on acquiring, developing, and managing self-storage properties, generating revenue through rental income and ancillary services. Their target market includes individuals moving, undergoing home renovations, downsizing, or needing temporary storage solutions, as well as small businesses requiring additional storage space.

Extra Space Storage’s competitive advantages include a large portfolio of well-located properties, a strong brand recognition, and a robust operational platform. However, disadvantages include intense competition within the self-storage industry, sensitivity to macroeconomic factors such as interest rates and economic downturns, and potential regulatory changes impacting the sector. The company was founded in 1977, with key milestones including significant acquisitions, strategic expansions into new markets, and consistent revenue growth over the years.

Factors Influencing Stock Price

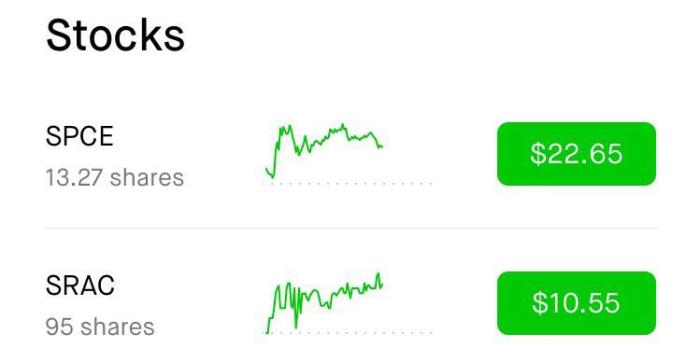

Source: redd.it

Several factors influence Extra Space Storage’s stock price. Macroeconomic conditions, such as interest rate hikes (increasing borrowing costs) and inflation (affecting construction and operating expenses), significantly impact profitability and investor sentiment. Industry-specific trends, including fluctuations in demand for self-storage driven by population shifts, housing market dynamics, and economic growth, also play a crucial role. Furthermore, company-specific events, including the release of financial reports showcasing revenue growth or earnings per share, successful acquisitions, and changes in management, can cause notable price fluctuations.

| Metric | Extra Space Storage | Competitor A | Competitor B |

|---|---|---|---|

| Revenue (Last Year) | $XXX Million (Illustrative Data) | $YYY Million (Illustrative Data) | $ZZZ Million (Illustrative Data) |

| EPS (Last Year) | $X.XX (Illustrative Data) | $Y.YY (Illustrative Data) | $Z.ZZ (Illustrative Data) |

| Stock Price Change (YTD) | +XX% (Illustrative Data) | +YY% (Illustrative Data) | +ZZ% (Illustrative Data) |

| Debt-to-Equity Ratio | X.XX (Illustrative Data) | Y.YY (Illustrative Data) | Z.ZZ (Illustrative Data) |

Note: Competitor names and financial data are illustrative and should be replaced with actual data from reliable sources.

Financial Performance Analysis

Extra Space Storage’s financial performance over the past five years has generally shown positive trends, although specific figures are subject to change. Revenue and earnings have typically grown year-over-year, indicating strong operational performance and consistent demand for self-storage services. However, debt levels and profitability margins should be analyzed in context with the company’s growth strategy and industry benchmarks.

A line chart illustrating the trend of Extra Space Storage’s revenue and earnings per share (EPS) would show the revenue (in millions of dollars) on the y-axis and the year (e.g., 2019-2023) on the x-axis. A separate line would represent EPS (in dollars) on the same y-axis and x-axis. Data points would reflect the actual revenue and EPS figures for each year.

The chart would visually depict the growth trajectory of both revenue and EPS over the period.

Comparing Extra Space Storage’s financial ratios, such as debt-to-equity and return on assets, to industry averages provides valuable context for assessing its financial health and performance relative to its peers. A higher-than-average debt-to-equity ratio might indicate higher financial risk, while a higher-than-average return on assets suggests efficient asset utilization.

Valuation and Investment Considerations

Several valuation methods can be employed to assess Extra Space Storage’s stock, including discounted cash flow (DCF) analysis, which projects future cash flows and discounts them back to their present value, and price-to-earnings (P/E) ratio, which compares the stock price to its earnings per share. These methods, alongside comparative analysis with competitors, help determine whether the stock is undervalued or overvalued.

Keeping an eye on the Extra Space Storage stock price requires considering broader market trends. For instance, understanding the performance of related transportation companies, like checking the current csx stock price today per share , can offer insights into potential impacts on logistics and demand. Ultimately, Extra Space Storage’s stock price is influenced by a variety of factors beyond just its own performance.

Investing in Extra Space Storage carries both risks and rewards. Financial risks include potential declines in revenue due to economic downturns or increased competition. Operational risks involve issues with property management, maintenance, or tenant acquisition. Regulatory risks stem from potential changes in zoning laws or environmental regulations. A scenario analysis could model the impact of different economic scenarios (e.g., recession, moderate growth, strong growth) on the stock price, using varying assumptions for revenue growth, interest rates, and occupancy rates.

Future Outlook and Predictions

Extra Space Storage’s future growth could be driven by several factors, including continued expansion into new markets, increasing demand for self-storage due to population growth and changing lifestyles, and successful acquisitions of existing facilities. However, challenges include intense competition, rising construction costs, and the potential for economic downturns to impact demand. Predicting the stock price in the next 12 months involves considering these factors and their potential impact on the company’s financial performance.

For example, a scenario of strong economic growth could lead to higher occupancy rates and increased revenue, driving a potential price increase. Conversely, a recession could negatively impact demand, leading to a price decline.

FAQ Insights

What is the current dividend yield for Extra Space Storage stock?

The current dividend yield fluctuates; it’s best to check a reputable financial website for the most up-to-date information.

How does Extra Space Storage compare to Public Storage in terms of market capitalization?

Public Storage generally has a significantly larger market capitalization than Extra Space Storage. This information is readily available through financial news sources and stock market data providers.

What are the major risks associated with investing in Extra Space Storage?

Major risks include interest rate hikes impacting borrowing costs, decreased demand for self-storage due to economic downturns, increased competition, and potential regulatory changes.

What is Extra Space Storage’s debt-to-equity ratio?

This ratio changes; refer to Extra Space Storage’s financial statements or a financial data provider for the most recent figures.