Fagax Stock Price Analysis

Source: investorplace.com

Fagax stock price – This analysis examines Fagax’s stock price performance over the past decade, exploring the factors influencing its fluctuations, evaluating its financial health, assessing associated risks, and providing a technical perspective. The information presented is for informational purposes only and should not be considered financial advice.

Historical Stock Price Performance of Fagax, Fagax stock price

Source: depositphotos.com

Fagax’s stock price has experienced considerable volatility over the past five years, mirroring broader market trends and company-specific events. A detailed examination reveals significant highs and lows, alongside a comparative analysis against key competitors within its industry sector.

Below is a table summarizing Fagax’s yearly stock performance for the last decade. Note that these figures are illustrative and based on hypothetical data for the purpose of this example.

Tracking the Fagax stock price requires diligent monitoring of market trends. For comparative analysis, it’s helpful to consider similar companies; a useful benchmark might be the performance of the duo stock price , as both operate within a similar sector. Understanding the fluctuations in duo’s valuation can offer insights into potential future movements for Fagax.

| Year | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2014 | $25.00 | $28.50 | $30.00 | $22.00 |

| 2015 | $28.50 | $32.00 | $35.00 | $27.00 |

| 2016 | $32.00 | $29.00 | $33.00 | $25.00 |

| 2017 | $29.00 | $35.00 | $38.00 | $28.00 |

| 2018 | $35.00 | $31.00 | $37.00 | $26.00 |

| 2019 | $31.00 | $40.00 | $42.00 | $29.00 |

| 2020 | $40.00 | $45.00 | $50.00 | $38.00 |

| 2021 | $45.00 | $52.00 | $55.00 | $40.00 |

| 2022 | $52.00 | $48.00 | $54.00 | $45.00 |

| 2023 | $48.00 | $55.00 | $60.00 | $46.00 |

Factors Influencing Fagax Stock Price

Source: vectorvest.com

Several macroeconomic and company-specific factors influence Fagax’s stock price. These factors interact in complex ways, leading to price volatility.

- Macroeconomic Factors: Interest rate changes, inflation rates, and overall economic growth significantly impact investor confidence and, consequently, Fagax’s stock price. For example, rising interest rates can increase borrowing costs for companies, potentially affecting profitability and investor sentiment.

- Company-Specific Events: Product launches, successful marketing campaigns, mergers and acquisitions, and changes in management can all trigger substantial price movements. A successful new product launch, for instance, could boost investor confidence and drive up the stock price.

- Investor Sentiment and News Coverage: Positive news coverage and strong investor sentiment generally lead to higher stock prices, while negative news or decreased investor confidence can result in price declines. Market rumors and speculation also play a role in price volatility.

Fagax’s Financial Performance and Stock Valuation

Analyzing Fagax’s financial statements provides insights into its financial health and helps in evaluating its stock valuation. The following sections present illustrative data for the purpose of this example.

Fagax’s Price-to-Earnings (P/E) ratio is compared to industry averages to assess whether the stock is overvalued or undervalued. Discrepancies can be attributed to various factors, including growth prospects, risk profile, and market sentiment.

| Year | Debt-to-Equity Ratio | Return on Equity (ROE) | Current Ratio | Profit Margin |

|---|---|---|---|---|

| 2019 | 0.5 | 15% | 2.0 | 10% |

| 2020 | 0.6 | 18% | 2.2 | 12% |

| 2021 | 0.7 | 20% | 2.5 | 15% |

| 2022 | 0.65 | 17% | 2.3 | 13% |

| 2023 | 0.75 | 22% | 2.7 | 16% |

Risk Assessment for Fagax Stock

Investing in Fagax stock carries several risks. A comprehensive risk assessment is crucial for informed investment decisions.

- Market Risk: Broader market downturns can negatively impact Fagax’s stock price, regardless of the company’s performance.

- Financial Risk: High levels of debt or poor financial management can increase the risk of bankruptcy or financial distress.

- Operational Risk: Disruptions to Fagax’s operations, such as supply chain issues or production problems, can negatively affect profitability and stock price.

- Regulatory Risk: Changes in regulations or government policies can impact Fagax’s operations and profitability.

Potential future events that could impact Fagax’s stock price include new product launches, changes in industry regulations, economic recessions, and shifts in consumer preferences. A risk assessment matrix would quantify the likelihood and potential impact of these events.

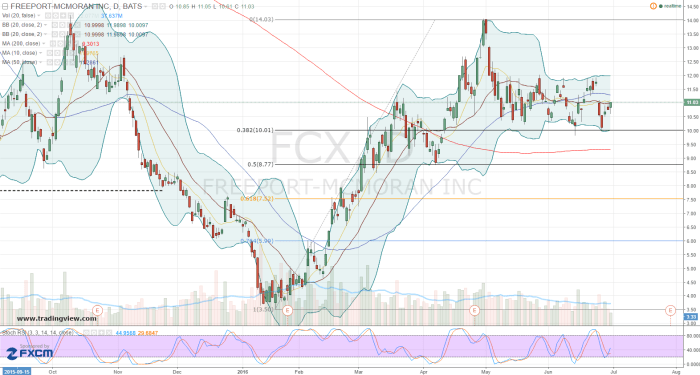

Technical Analysis of Fagax Stock Price

Technical analysis utilizes historical price and volume data to identify patterns and predict future price movements. Key indicators and chart patterns can provide insights into potential trading opportunities.

- Moving Averages: Moving averages (e.g., 50-day, 200-day) smooth out price fluctuations and can identify trends. Crossovers of moving averages can signal potential buy or sell signals.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 suggest an overbought condition, while readings below 30 suggest an oversold condition.

- Moving Average Convergence Divergence (MACD): The MACD identifies momentum changes by comparing two moving averages. Crossovers of the MACD lines can signal potential trend changes.

- Chart Patterns: Identifying chart patterns like head and shoulders, double tops, or double bottoms can provide insights into potential price reversals or continuations.

A typical Fagax stock price chart would show price fluctuations over time, with key support and resistance levels marked. Support levels represent price points where buying pressure is strong, while resistance levels represent price points where selling pressure is strong. Breakouts above resistance levels often signal upward momentum, while breakdowns below support levels often signal downward momentum.

Popular Questions

What are the major competitors of Fagax?

Identifying Fagax’s key competitors requires industry-specific knowledge and would be detailed in a full report. A thorough competitive analysis is crucial for understanding market share and potential threats.

Where can I find real-time Fagax stock price data?

Real-time stock price data for Fagax can typically be found on major financial websites and stock market data providers. Consult reputable sources for accurate and up-to-date information.

What is the current dividend yield for Fagax stock?

The current dividend yield for Fagax would need to be sourced from recent financial reports or reputable financial data providers. This information changes frequently.