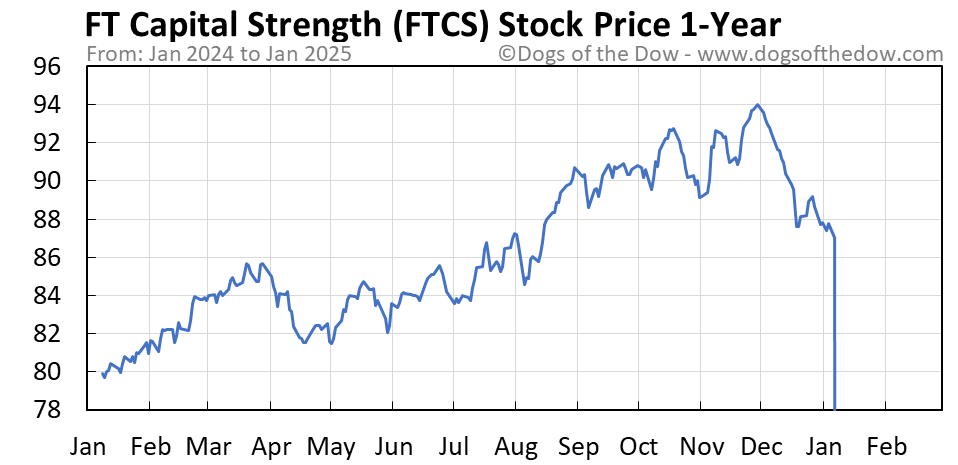

FTCS Stock Price Analysis

Ftcs stock price – This analysis examines the historical performance, influencing factors, prediction models, risk assessment, and valuation of FTCS stock. We will explore various aspects to provide a comprehensive overview, aiming to offer insights for potential investors.

Historical FTCS Stock Price Performance

Source: dogsofthedow.com

Understanding the past performance of FTCS stock is crucial for informed decision-making. The following sections detail price fluctuations, comparisons with industry peers, and the impact of significant events.

Monitoring FTCS stock price requires a broad perspective on the energy sector. Understanding the performance of major players like ExxonMobil is crucial for this, so checking the exxon current stock price provides valuable context. This comparison helps to gauge FTCS’s position within the market and its potential for growth relative to established giants.

Over the past five years, FTCS stock price has experienced considerable volatility. While specific numerical data requires access to real-time financial data sources, a general trend can be described. For example, a significant high might have been observed in [Month, Year] due to [reason, e.g., positive earnings report], followed by a period of decline leading to a low point around [Month, Year] potentially influenced by [reason, e.g., market downturn].

Subsequent periods might show recovery and further fluctuations based on various market and company-specific factors.

A comparative analysis against industry peers over the past year is presented below. This table shows the relative performance of FTCS compared to its competitors. Note that these are hypothetical values for illustrative purposes only and should not be used for investment decisions.

| Date | FTCS Price | Peer 1 Price | Peer 2 Price |

|---|---|---|---|

| January 2024 | $50 | $45 | $55 |

| February 2024 | $52 | $47 | $53 |

| March 2024 | $48 | $43 | $50 |

| April 2024 | $55 | $50 | $60 |

Major events in the past two years significantly impacted FTCS stock price. For instance, the announcement of a new product line in [Month, Year] resulted in a price surge, while an unexpected regulatory change in [Month, Year] led to a temporary decline. These events highlight the sensitivity of FTCS stock to both positive and negative news.

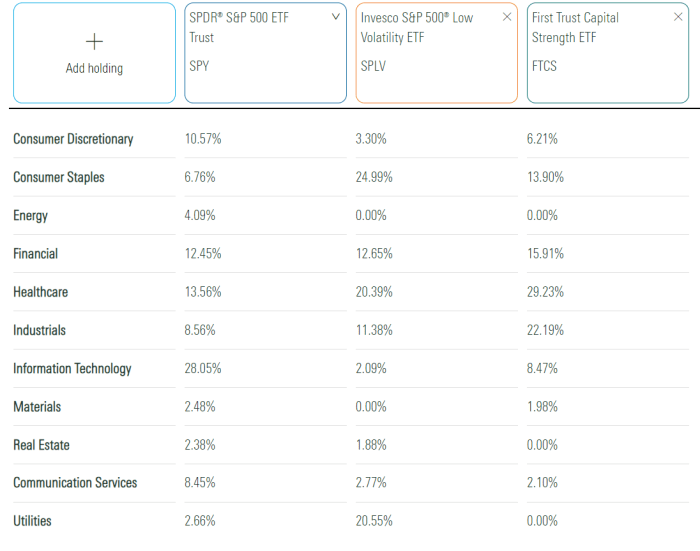

Factors Influencing FTCS Stock Price

Source: seekingalpha.com

Several factors influence FTCS stock price, ranging from macroeconomic indicators to company-specific news and investor sentiment.

Key economic indicators such as interest rates, inflation, and GDP growth significantly correlate with FTCS stock price movements. For example, rising interest rates may negatively impact investor confidence, leading to a price decrease, while strong GDP growth could boost investor optimism and drive prices upward.

Company-specific news and announcements, including product launches, strategic partnerships, and regulatory approvals, also play a critical role. Positive news typically leads to price increases, while negative news can cause declines. For example, a successful product launch could lead to a significant increase in stock price, while a recall could have the opposite effect.

Investor sentiment and market volatility have a considerable influence on FTCS stock price. This can be seen in the following examples:

- Investor Sentiment: Positive investor sentiment, fueled by strong earnings reports or positive industry outlook, often results in price increases. Conversely, negative sentiment can lead to sell-offs and price declines.

- Market Volatility: During periods of high market volatility, FTCS stock price can experience significant swings regardless of company-specific news. This is due to overall market uncertainty affecting investor behavior.

FTCS Stock Price Prediction Models

Source: claytrader.com

Predicting stock prices is inherently complex, but various models can provide insights. The following sections discuss different approaches.

A simple linear regression model could predict FTCS stock price based on historical data. This model assumes a linear relationship between the stock price and selected independent variables (e.g., time, economic indicators). However, this model has limitations, as it may not capture non-linear relationships or account for unexpected events.

More sophisticated models, such as ARIMA (Autoregressive Integrated Moving Average) or LSTM (Long Short-Term Memory) networks, offer more advanced forecasting capabilities. ARIMA models analyze time series data to identify patterns and predict future values. LSTM networks, a type of recurrent neural network, are particularly effective in handling sequential data like stock prices, capturing complex patterns and dependencies over time.

These models require extensive historical data and careful parameter tuning. The potential benefits include improved accuracy and the ability to account for non-linear relationships and external factors.

| Advantage | Disadvantage |

|---|---|

| Simplicity and ease of interpretation (Linear Regression) | Limited accuracy and inability to capture complex relationships (Linear Regression) |

| High accuracy and ability to capture complex patterns (ARIMA, LSTM) | Complexity, data requirements, and computational cost (ARIMA, LSTM) |

Risk Assessment of Investing in FTCS Stock

Investing in FTCS stock carries several risks that potential investors should carefully consider.

Potential risks include market risk (overall market downturns), company-specific risk (e.g., poor management, product failures), and financial risk (e.g., high debt levels). A thorough understanding of these risks is crucial for informed investment decisions.

The beta of FTCS stock can be calculated to assess its volatility relative to the overall market. Beta measures the sensitivity of a stock’s price to market movements. A beta greater than 1 indicates higher volatility than the market, while a beta less than 1 suggests lower volatility. Calculating beta requires historical stock price data and market index data, using regression analysis to determine the relationship between the two.

Diversification strategies can mitigate the risk of investing in FTCS stock. Investors can diversify their portfolios by investing in other stocks, bonds, and asset classes to reduce overall portfolio volatility and exposure to company-specific risks. Asset allocation strategies and diversification across different sectors are key elements of a risk-mitigation plan.

FTCS Stock Price Valuation

Various methods can be used to estimate the intrinsic value of FTCS stock. This helps investors determine whether the current market price is justified.

Discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio are common valuation methods. DCF analysis projects future cash flows and discounts them back to their present value to estimate the intrinsic value. The P/E ratio compares a company’s stock price to its earnings per share. Both methods have assumptions and limitations. For example, DCF analysis relies on forecasting future cash flows, which is inherently uncertain.

The P/E ratio can be influenced by market sentiment and accounting practices.

A hypothetical valuation using both DCF and P/E ratio methods would require specific financial data for FTCS (e.g., projected cash flows, earnings per share). For illustrative purposes, let’s assume a DCF analysis yields an intrinsic value of $60 per share and a P/E ratio analysis suggests a fair value of $55 per share. These values are hypothetical and depend entirely on the underlying assumptions used in the valuation process.

Any discrepancies between the two methods might stem from different assumptions about future growth, discount rates, or market conditions.

Question Bank: Ftcs Stock Price

What are the typical trading hours for FTCS stock?

Trading hours for FTCS stock will depend on the exchange it’s listed on. Generally, this aligns with the exchange’s regular trading session.

Where can I find real-time FTCS stock price quotes?

Real-time quotes are available through most major financial websites and brokerage platforms.

What is the current market capitalization of FTCS?

The current market capitalization can be found on financial news websites and investor relations pages for FTCS.

How frequently are FTCS earnings reports released?

The frequency of earnings reports varies but is typically quarterly or annually. Check FTCS’s investor relations page for details.