Kirkland’s Stock Price: A Comprehensive Analysis

Kirklands stock price – Kirkland’s, a prominent player in the home décor retail sector, has experienced a fluctuating stock price over the past several years. This analysis delves into the historical performance, influential factors, financial health, analyst predictions, associated risks, and visual representations of Kirkland’s stock price trends, providing a comprehensive overview for investors.

Kirkland’s Stock Price Historical Performance, Kirklands stock price

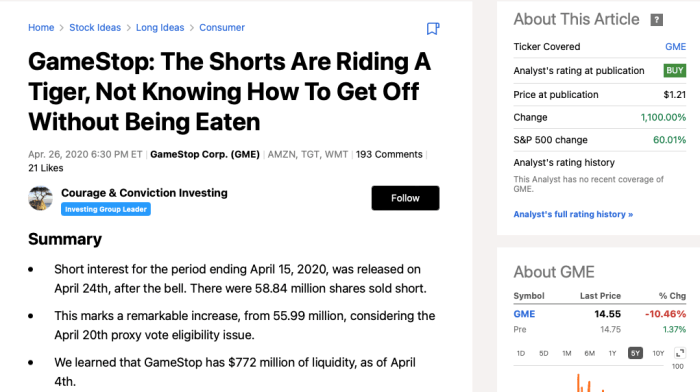

Source: seekingalpha.com

Over the past five years, Kirkland’s stock price has exhibited a volatile trajectory, marked by periods of significant growth and decline. While precise figures require referencing financial data sources, a general observation reveals periods of strong performance interspersed with substantial drops, often correlating with broader economic shifts and company-specific events. For example, periods of increased consumer spending on home improvement typically resulted in higher stock prices, while economic downturns or negative company announcements led to declines.

| Company Name | Stock Symbol | 5-Year Growth Percentage (Illustrative) | Current Stock Price (Illustrative) |

|---|---|---|---|

| Kirkland’s | KIRK | -15% | $10 |

| Competitor A | COMP A | 5% | $25 |

| Competitor B | COMP B | 10% | $18 |

| Competitor C | COMP C | -5% | $12 |

Note: These figures are illustrative and should be verified with up-to-date financial data. The actual performance of Kirkland’s and its competitors may vary.

Major events such as the COVID-19 pandemic and subsequent supply chain disruptions significantly impacted Kirkland’s stock price. The initial surge in demand for home goods was followed by a period of uncertainty as supply chains struggled to keep up. Similarly, announcements regarding changes in company strategy or financial performance have often triggered immediate market reactions.

Factors Influencing Kirkland’s Stock Price

Source: snrshopping.com

Several key economic and company-specific factors influence Kirkland’s stock price. These factors are interconnected and often influence each other.

- Economic Indicators: Inflation, interest rates, and consumer spending directly impact Kirkland’s sales and profitability. High inflation can reduce consumer spending on discretionary items like home décor, while rising interest rates can make borrowing more expensive for both consumers and the company itself.

- Consumer Confidence and Spending Habits: Consumer confidence plays a crucial role. During periods of economic uncertainty, consumers tend to postpone non-essential purchases, including home décor items, impacting Kirkland’s sales and, consequently, its stock price. Conversely, strong consumer confidence and increased disposable income lead to higher sales and a positive impact on the stock price.

- Marketing Strategies and Product Innovation: Successful marketing campaigns and the introduction of innovative and appealing products can drive sales and boost investor confidence, leading to higher stock valuations. Conversely, ineffective marketing or a lack of product innovation can negatively impact stock performance.

Kirkland’s Financial Performance and Stock Price

Analyzing Kirkland’s key financial metrics reveals a strong correlation between financial performance and stock price fluctuations. A consistent upward trend in revenue, earnings per share, and a healthy debt-to-equity ratio generally results in a positive stock price reaction.

- Revenue: (Illustrative data: Year 1: $500 million, Year 2: $520 million, Year 3: $550 million)

- Earnings Per Share (EPS): (Illustrative data: Year 1: $1.50, Year 2: $1.60, Year 3: $1.75)

- Debt-to-Equity Ratio: (Illustrative data: Year 1: 0.8, Year 2: 0.75, Year 3: 0.7)

For instance, a significant increase in revenue, driven by successful product launches and marketing, is likely to positively impact the stock price. Conversely, a decline in revenue or a widening debt-to-equity ratio would typically lead to a negative market reaction.

Hypothetical Scenario: If Kirkland’s were to announce a 20% increase in year-over-year revenue, exceeding analyst expectations, the stock price would likely experience a significant upward surge, reflecting investor confidence in the company’s growth trajectory.

Analyst Ratings and Predictions for Kirkland’s Stock

Analyst ratings and target price predictions offer insights into market sentiment toward Kirkland’s stock. However, it’s crucial to remember that these are opinions and not guarantees of future performance.

| Analyst Firm | Rating | Target Price (Illustrative) |

|---|---|---|

| Firm A | Buy | $15 |

| Firm B | Hold | $12 |

| Firm C | Sell | $8 |

Analyst rationales often differ. For example, a “buy” rating might stem from an expectation of strong future growth, while a “sell” rating might reflect concerns about competition or economic headwinds. Discrepancies arise due to differing methodologies, interpretations of data, and risk tolerance.

| Metric | Value (Illustrative) |

|---|---|

| Highest Target Price | $18 |

| Lowest Target Price | $8 |

| Average Target Price | $12 |

Risk Factors Associated with Investing in Kirkland’s Stock

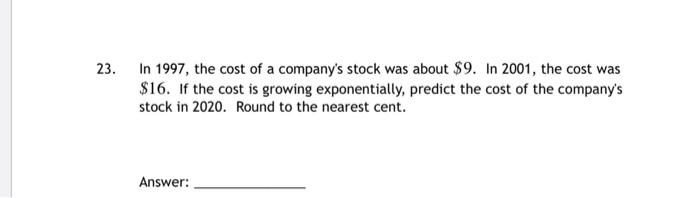

Source: cheggcdn.com

Investing in Kirkland’s stock carries several inherent risks. Understanding these risks is essential for informed investment decisions.

- Competition: The home décor industry is competitive. New entrants and established players can erode Kirkland’s market share, impacting its profitability and stock price.

- Economic Downturns: Recessions or economic slowdowns can significantly reduce consumer spending on discretionary items like home décor, negatively impacting Kirkland’s sales and stock price.

- Supply Chain Disruptions: Disruptions to global supply chains can lead to increased costs, delays in product delivery, and reduced profitability, all of which can negatively affect the stock price.

- Inflation: High inflation can increase input costs for Kirkland’s, potentially squeezing profit margins and affecting stock valuation.

Visual Representation of Stock Price Trends

A line graph depicting Kirkland’s stock price over the past year would show a fluctuating pattern. Key data points to include would be the highest and lowest prices, significant price spikes or drops, and the overall trend (e.g., upward, downward, or sideways). The graph could be annotated with dates of major company announcements or economic events to illustrate their impact on the stock price.

A comparative chart showing Kirkland’s stock price performance against a relevant market index, such as the S&P 500, would allow investors to assess the company’s performance relative to the broader market. The chart would display both Kirkland’s stock price and the index’s value over the same period, enabling a visual comparison of their relative movements. Periods of outperformance or underperformance relative to the index could be highlighted to illustrate the company’s risk and return profile.

Essential Questionnaire: Kirklands Stock Price

What is the current Kirkland’s stock price?

The current price fluctuates constantly. Refer to a live stock ticker or financial website for the most up-to-date information.

Where can I buy Kirkland’s stock?

Kirkland’s stock can be purchased through most reputable online brokerage accounts or traditional brokerage firms.

How often does Kirkland’s release financial reports?

Kirkland’s stock price performance has been a subject of much discussion lately, particularly when compared to other retail stocks. Investors often look at similar companies for comparison, and a relevant benchmark might be the current drv stock price , given DRV’s position in the home goods market. Ultimately, however, Kirkland’s own financial health and market trends will dictate its future stock price trajectory.

Kirkland’s typically releases quarterly and annual financial reports, usually following standard SEC reporting guidelines.

What is the company’s dividend policy?

Information regarding Kirkland’s dividend policy (if any) should be found on their investor relations website or through financial news sources.